RBI Tightens Norms, Raises Risk Weights For Personal Loans And Credit Cards

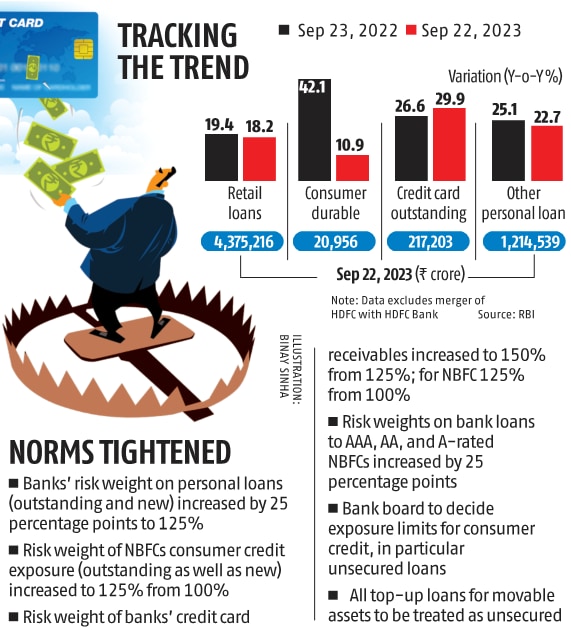

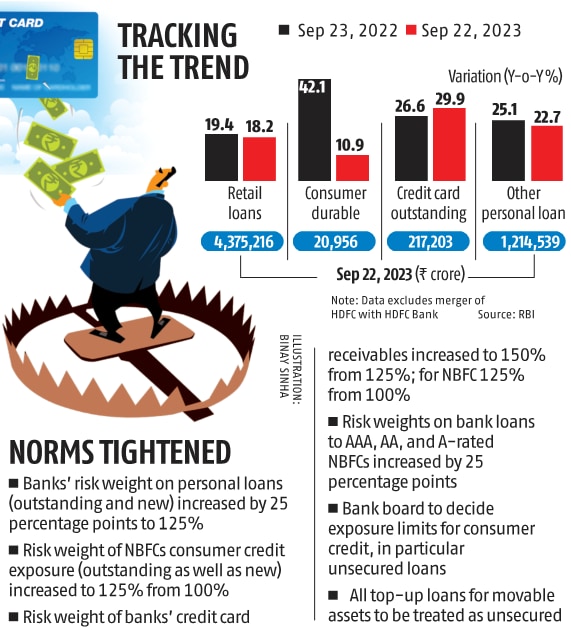

MUMBAI: After cautioning banks and non-banking financial companies (NBFCs) on surging unsecured loans like personal loans and those on the credit card, the Reserve Bank of India (RBI) on Thursday increased the risk weighting for such loans from 100 per cent to 125 per cent.

The risk weighting for bank loans to higher-rated NBFCs too has been increased by 25 percentage points.

The new norms, which take immediate effect, are applicable for new as well as outstanding loans.

As the increase in risk weighting will mean banks have to set aside more capital while extending such loans, the lenders in turn could increase the lending rates on such products.

“…it has been decided to increase the risk weights in respect of consumer credit exposure of commercial banks (outstanding as well as new), including personal loans, but excluding housing loans, education loans, vehicle loans and loans secured by gold and gold jewellery, by 25 percentage points to 125 per cent,” the RBI said.

According to the RBI data, bank credit growth has been around 20 per cent, growth in loans on the credit card around 30 per cent, and personal loans around 25 per cent.

Loan portfolios that are likely to be affected due to the increase in risk weighting are about 30 per cent of the banks’ retail portfolio, which was around Rs 48.26 trillion at the end of September.

“There was relatively high growth in consumer credit and unsecured loans in the recent past. Increasing the risk weighting is one way to enhance the sensitivity of banks and NBFCs to strengthen internal resilience,” said Krishnan Sitaraman, senior director and chief ratings officer, CRISIL Ratings Ltd.

“With the risk weighting going up by only 25 per cent and the extent of portfolio impacted not being very substantial, we expect the impact on banks’ capital adequacy ratio to not be material. Also banks are well capitalised now and should not face much of an issue in managing the impact. The larger message here seems to be on being proactive in exercising caution and strengthening internal surveillance. In the past, we’ve seen relatively high loan growth in certain segments being followed by NPAs going up,” Sitaraman told Business Standard.

During the October review of the monetary policy, RBI Governor Shaktikanta Das flagged the high growth of “certain components of personal loans” and said those were being closely monitored for any signs of incipient stress. He advised banks and NBFCs to strengthen their internal surveillance mechanisms, and address the build-up of risks.

“The need of the hour is robust risk management and stronger underwriting standards,” Das said.

In September 2019, the RBI had lowered the risk weighting of personal loans to 100 per cent in line with most other categories of retail loans.

The RBI has also increased the risk weights for banks credit to NBFCs, by 25 percentage points.

According to norms, exposures of scheduled commercial banks to NBFCs, excluding core investment companies, are risk weighted as per the ratings assigned by accredited external credit assessment institutions.

“On a review, it has been decided to increase the risk weights on such exposures of SCBs by 25 percentage points (over and above the risk weight associated with the given external rating) in all cases where the extant risk weight as per external rating of NBFCs is below 100 per cent,” the RBI said.

The risk weight increase for bank loans to NBFCs will be applicable to AAA, AAA, and A rates NBFCs. BBB+ and for all others, the risk weight is already 100 per cent.

The risk weight for lending to an AAA-rated NBFC is 20 per cent, which will go up to 45 per cent. The risk weight of AA rated NBFC is 30 per cent, which will now become 55 per cent. For A-rated NBFC, risk weight is 50 per cent, which will be 75 per cent now. Bank credit to NBFC is roughly 10 per cent of the total loans. Of that a proportion would be to AAA-, AA-, & A-rated NBFCs. The increase in risk weights are applicable for all loans, except to housing finance companies, and loans to NBFCs which are eligible for classification.

Similarly, the risk weighting for consumer credit exposure of NBFCs, which are essentially retail loans, increased to 125 per cent from 100 per cent except housing loans, educational loans, vehicle loans, loans against gold jewellery and microfinance/self-help group loans.

The risk weighting on credit card receivables of banks and NBFCs has also been increased. For banks, it has been increased from 125 per cent to 150 per cent and for NBFCs 100 per cent to 125 per cent.

“The increase in risk weighting for consumer loans is in line with expectations, though an increase in risk weighting for lending by banks to non-banks was unexpected,” said Karthik Srinivasan, senior vice-president and group head, financial sector ratings, ICRA.

“These announcements are expected to result in higher capital requirements for lenders and hence an increase in lending rates for borrowers. These higher lending rates by banks to non-banks could also spill over to corporate bonds by way of higher yields and widening of credit spreads for non-banks,” Srinivasan said.

According to norms, exposures of scheduled commercial banks to NBFCs, excluding core investment companies, are risk weighted in accordance with the ratings assigned by accredited external credit assessment institutions.

“When you increase lending rates, loan growth can be calibrated. That said, fundamentally there continues to be good demand for retail loans, which is driven by decent economic growth whereby India today is the fastest-growing large economy in the world,” Sitaraman said.

The regulator has asked lenders to review their sectoral exposure limits for consumer credit and put in place board-approved limits in respect of various sub-segments under consumer credit.

The norms on board-approved limits should be implemented by February 29, 2024, the RBI said.

Source: Business Standard

The post RBI Tightens Norms, Raises Risk Weights For Personal Loans And Credit Cards first appeared on Latest India news, analysis and reports on IPA Newspack.